Tax repayment awarded to date: £330K

Pelican Exchange Limited have developed an innovative app that’s revolutionised the way people trade. As well as enabling users to buy and sell, its platform also allows them to chat, get advice and keep up to date with the latest happenings in the world’s financial markets – 24 hours a day.

With the deadline for an R&D tax relief claim only 2 weeks away, Pelican’s co-founder and director, Peter Read, was introduced to us when he couldn’t find an advisor to help him submit a claim on time.

Thanks to a flexible approach working closely with Peter and Pelican’s accountant, we were able to gather all the information and complete everything for him. And, in this instance, it was agreed that Simtax would submit the claims so as to meet the deadline.

Overall, the development project had been complex, costly and time-consuming; bringing together a unique combination of financial market expertise and best-of-breed software specialists to develop the app’s unique software.

As a result of our input helping Pelican to achieve tax credit repayments over £330k, they’re now able to use this funding to invest in further development.

This process had the potential to be very labour intensive but thanks to Simone’s help it has been very straightforward. Being a young start-up, we’ve been somewhat reliant on the cash from the R&D claims in recent years. Simone was always on hand to guide us through the process to ensure we submitted our application in a timely manner – saving us stress, time and money. I wouldn’t hesitate to recommend Simtax as a professional and efficient solution to any tax advisory issue.

Callum Kellas, Operations and Accounts Manager, Pelican Exchange Ltd

£240k of tax saved so far

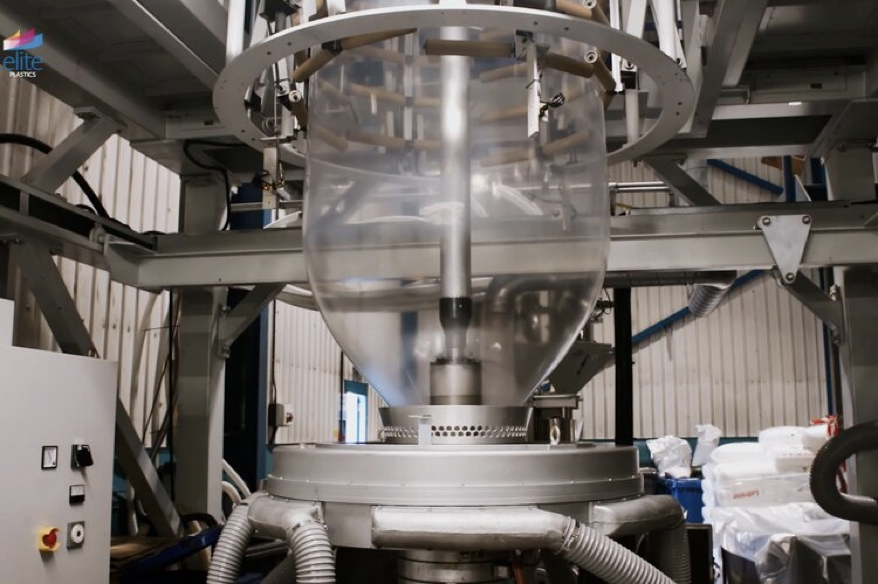

Elite is an industry leading extruder, printer, and converter of polythene films, bags & covers. With over 100,000 square foot of purpose-built production site, they manufacture innovative, sustainable, carbon neutral, polythene for the evolving market.

Elite carries out many innovative R&D projects, adapting and appreciably improving manufacturing processes and product recipes to stay at the forefront of their industry.

The client was unaware they could make an R&D tax relief claim for the work they did to improve products, sustainability and manufacturing technology until they were introduced to us by another Simtax client.

After an initial meeting, we worked closely with Elite through each step of the process. We set out the different options resulting from the R&D tax relief claims to make sure Elite knew which was the most tax efficient and which would be of most benefit to the company.

Elite has been able to reinvest their valuable tax savings into further innovation, to maintain their competitive edge and help reduce the carbon footprint of Polythene.

Simone at Simtax UK fully explained the R&D relief rules and process to us and has guided us through several years of claims in relation to our R&D costs. Even for those projects which were unsuccessful. We already have Auditors but Simone’s specialist and practical knowledge in this field has been invaluable to Elite. Simone not only guided us through the claim procedure and formalised our applications but she also liaised and linked in with our Auditors to ensure Corporation Tax Returns were adjusted and submitted to reflect the R&D tax reliefs obtained. Our R&D tax relief claims would not have been so successful or as smooth to process without forming this fantastic working association with Simtax.

David Gummerson, Managing Director, Elite Plastics Ltd

Tax credit repayments and tax reductions awarded to date: over £2.5m

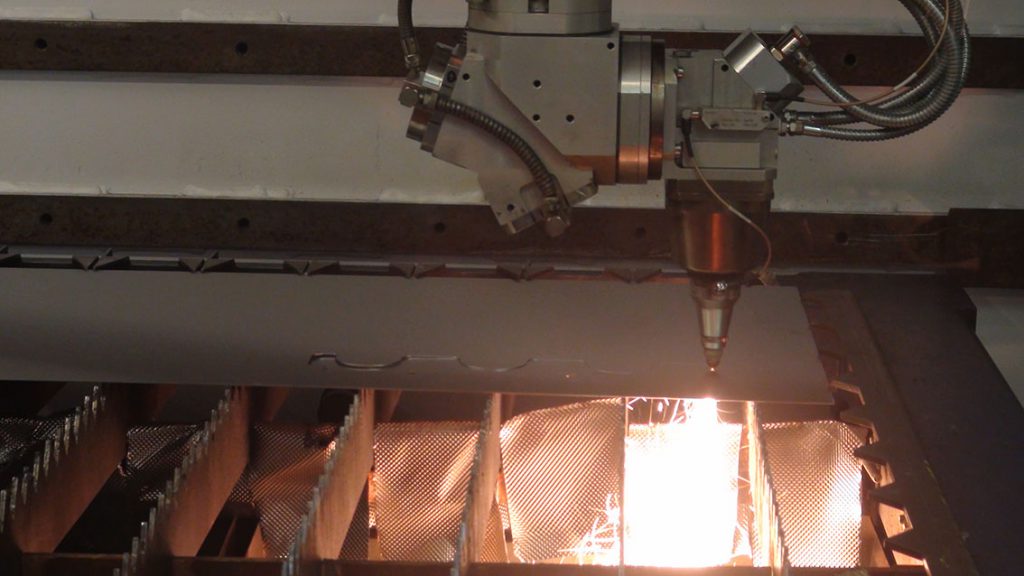

SST Technology and Lentus Composites are part of the Polar Technology Management Group based in Eynsham, Oxfordshire. SST Technology is an engineering business specialising in the design and manufacture of bespoke, advanced precision fabrications and thermal management systems for high-tech industries.

Lentus Composites is an engineering-led manufacturer of composite products, assemblies and systems for a range of industry sectors. They design, analyse, prototype and qualification-test parts before then moving onto their low or high-volume production.

Both companies are rapidly expanding and focused on innovating, developing or appreciably improving manufacturing processes – particularly when working with new materials and prototype components/products.

As part of a medium-sized group, the companies claimed under the SME scheme for unfunded projects and also under the RDEC scheme for projects receiving government grants (or those subcontracted by a ‘Large’ company).

We helped advise on the group tax position – on how best to use the R&D tax relief available and also how to optimise R&D capital allowances.

As a result, and over the last 4 years, SST and Lentus achieved SME tax credit repayments, R&D Expenditure Credits and reductions in corporation tax that totalled well over £2.5m.

Simtax have worked with us for 4 years. They take a logical and methodical approach to understanding our business and have highlighted many opportunities to claim R&D tax credit payments. The continued success over the years has enabled us to reinvest over £2.5m of cash back into our business, to fund growth and working capital requirements.

Dr SSJ Roberts, Chairman, Polar Technology Management Group

MORE THAN £47K OF TAX SAVED SO FAR

The Figaro Shop specialise in providing an unrivalled range of services for Nissan Figaros – from sales of handpicked, low mileage Nissan Figaros, all made to bespoke specifications, to complete renovation and refurbishment of owner’s cars. The Company also has its own parts department selling replacement and upgraded items.

Many of the Figaro’s parts are no longer in production so the Company has had to develop component parts that were otherwise unavailable. This has meant developing different manufacturing processes as the original mass manufacturing process is no longer suitable. Also, when developing replacement parts new/different materials have been trialled leading to more resilient, better performing parts.

The Company’s research and development on new parts and manufacturing processes have enabled them to create the very best Figaros on the market. As well as providing tax savings that can be reinvested into further improvements.

Simtax were introduced to The Figaro Shop by a mutual contact when the Company was unaware they could be eligible for R&D tax relief. During the initial meeting we explained the process and helped with identifying the list of potentially qualifying projects and how best to extract the qualifying expenditure from the accounting records. Using Simtax’ report template helped gather the technical information needed to support the claims. The claim process is efficient and coordinated with the company accounts preparation to save time and tax.

Simtax have helped us to be able to spend more time on our parts development and create better products. As a result, we have been able to improve the service to our clients and also be more profitable. Their service has always been very efficient and they took time to guide us through the process. We highly recommend them.

Tobyn Brooks, Owner/Founder, The Figaro Shop Limited